Streamline Loan Processing with Custom CRM

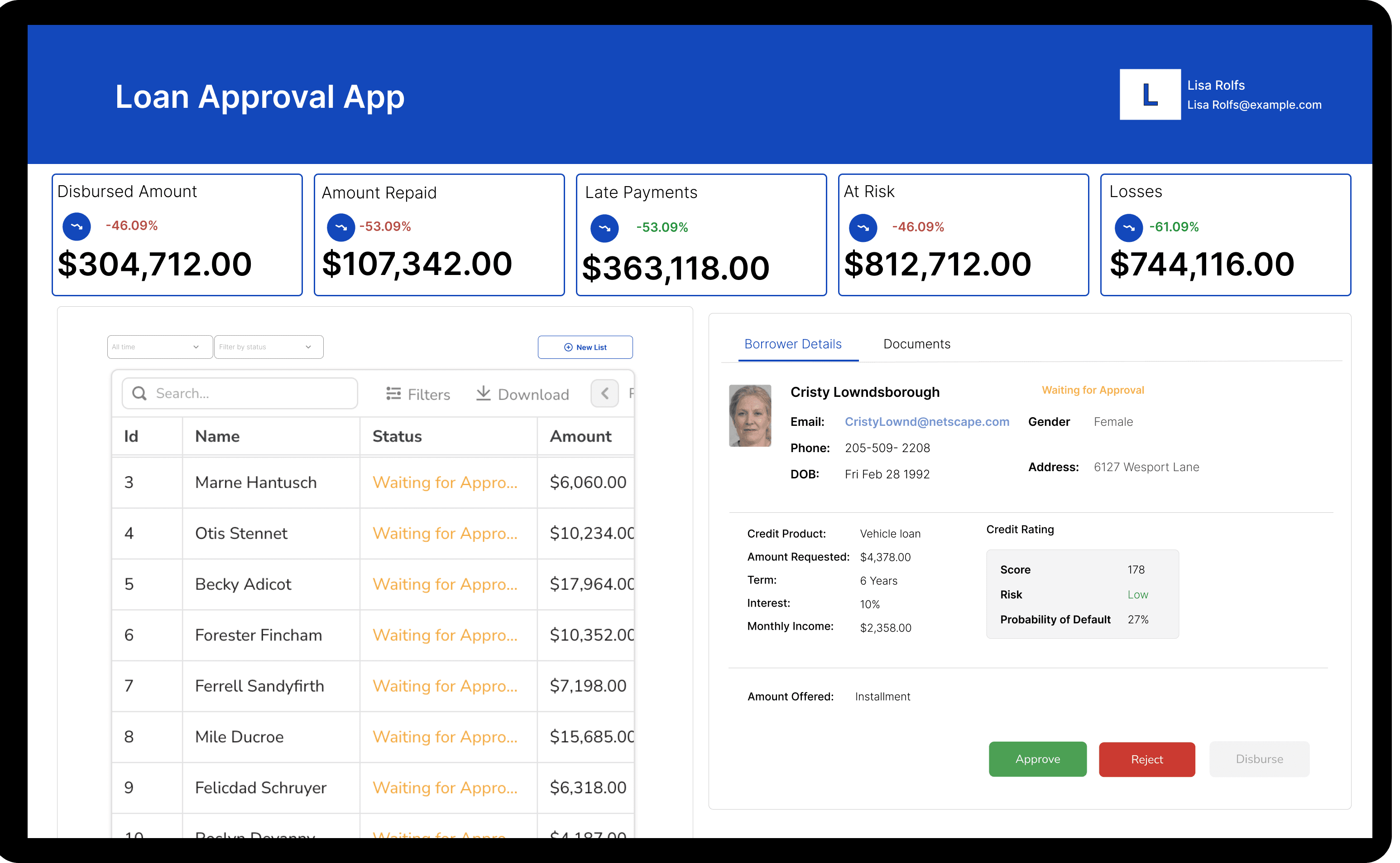

Simplify loan management, improve customer experience, and accelerate loan processing with a custom CRM for loan processing built on Appsmith in no time.

FAQs

What are the common features of a Crm for loan processing

What are the common features of a Crm for loan processing

Common features of a CRM for loan processing include lead management, loan application tracking, document management, customer communication, and reporting. These features help streamline the loan approval process, reduce manual work, and enhance customer satisfaction. With Appsmith, you can build a tailored CRM for loan processing using 45+ pre-built widgets and a wide range of integrations, enabling you to create a seamless experience for your users without extensive front-end or design expertise.

Why build a Crm for loan processing instead of buying one?

Why build a Crm for loan processing instead of buying one?

Building a CRM for loan processing with Appsmith offers numerous advantages over buying an off-the-shelf solution. Custom-built CRMs provide flexibility, allowing you to tailor the system to your specific business needs and processes. This ensures a better fit for your organization, leading to increased efficiency and productivity. Additionally, custom CRMs are often more cost-effective in the long run, as you avoid recurring subscription fees and can scale the system as needed. With Appsmith's low-code platform, even non-technical users can create a powerful CRM for loan processing without extensive coding knowledge.

What are the challenges of building a Crm for loan processing?

What are the challenges of building a Crm for loan processing?

Challenges of building a CRM for loan processing include ensuring seamless integration with existing systems, maintaining data security and compliance, and providing a user-friendly interface for both technical and non-technical users. Appsmith's low-code platform helps overcome these challenges by offering pre-built connectors for various data sources, robust security features, and an intuitive drag-and-drop interface for building user interfaces.

Which teams use Crm for loan processing the most?

Which teams use Crm for loan processing the most?

Teams that use CRM for loan processing the most include loan officers, underwriters, processors, and customer service representatives. These teams benefit from a centralized system that streamlines loan application tracking, document management, and customer communication. A CRM for loan processing helps improve collaboration, reduce manual work, and enhance overall efficiency across the organization.

Why Appsmith for CRM for loan processing?

Rapid Development with Low-Code Platform

Appsmith's low-code platform enables software engineers to quickly build and deploy a CRM for loan processing. With an intuitive drag-and-drop interface and pre-built components, developers can create custom solutions tailored to their organization's needs without spending extensive time on coding.

Seamless Integration with Data Sources

Appsmith offers pre-built connectors for various data sources, such as PostgreSQL, MongoDB, Snowflake, Amazon S3, Airtable, REST APIs, and GraphQL endpoints. This allows developers to easily integrate their CRM for loan processing with existing systems and databases, ensuring a seamless flow of data across the organization.

Customizable UI with Extensive Widgets

Developers can create a user-friendly interface for their CRM for loan processing using Appsmith's extensive library of widgets. These pre-built components, such as tables, forms, charts, and buttons, enable developers to design a visually appealing and interactive UI tailored to their organization's requirements.

Do magic with widgets

Table Widget for Data Management

The Table Widget in Appsmith allows developers to display, sort, and filter loan application data, making it easy for users to manage and track loan applications throughout the processing cycle.

Form Widget for Data Collection

The Form Widget enables developers to create custom forms for capturing loan application data, ensuring that all necessary information is collected efficiently and accurately.

Chart Widget for Visualizing Data

The Chart Widget helps developers create interactive charts and graphs to visualize loan processing data, enabling users to gain insights and make data-driven decisions.

Get live support from our team or ask and answer questions in our open-source community.

Watch video tutorials, live app-building demos, How Do I Do X, and get tips and tricks for your builds.

Discord

Videos

Do more with Appsmith

Ship a portal today.

We’re open-source, and you can self-host Appsmith or use our cloud version—both free.