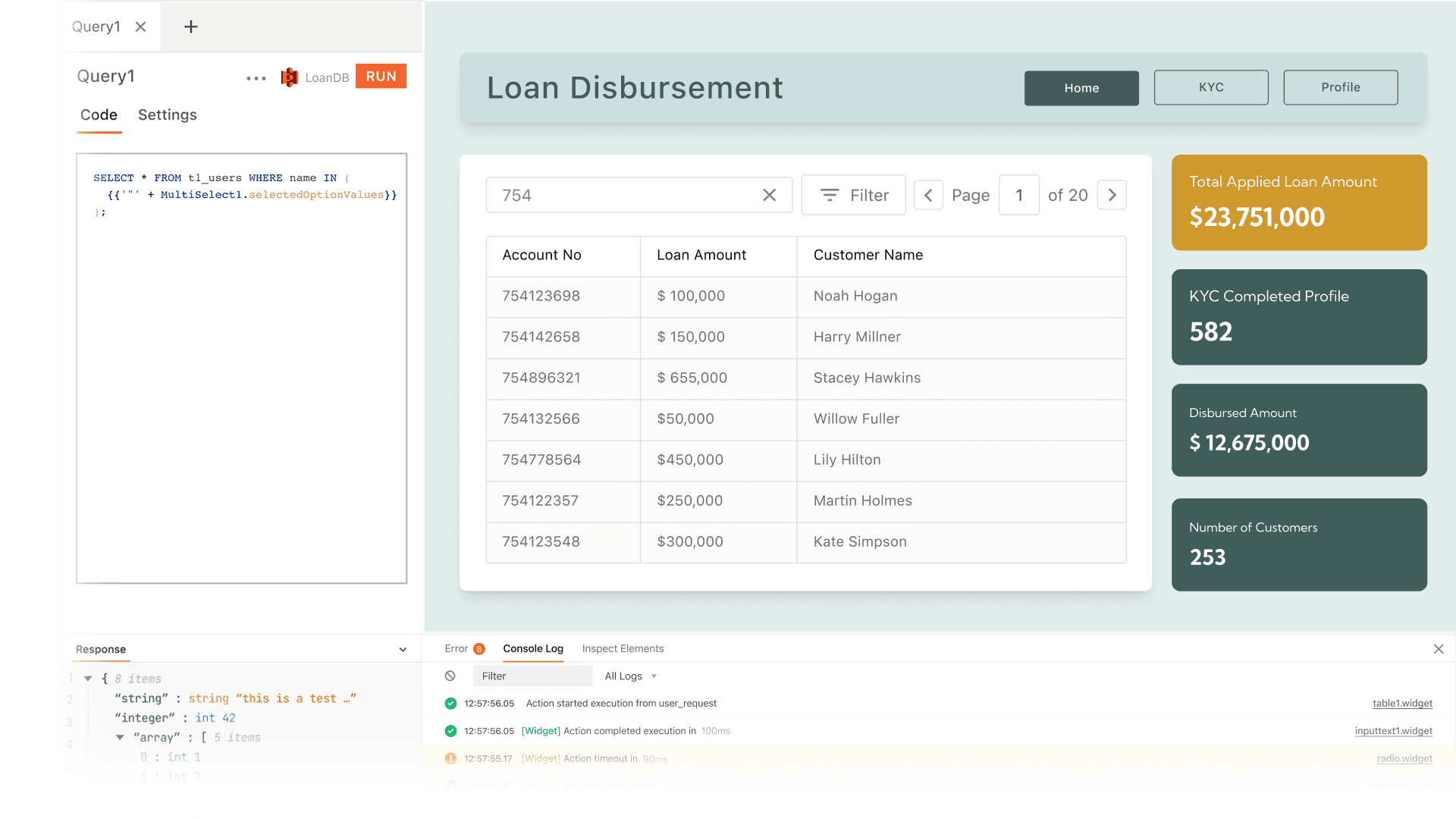

Ship an online loan disbursement system quickly.

Automate your entire loan disbursement process - from loan applications, verification of the borrower's identity, and credit risk assessment to loan disbursement. Get all your teams on the same loan disbursement tool, irrespective of which part of the process they are involved in.

What is a loan disbursement system?

An online loan disbursement system allows borrowers to apply for and receive loans through an online platform, rather than having to go to a physical bank or lender.

What are some common features of a loan disbursement system?

What are some common features of a loan disbursement system?

Workflow automation: for managing the entire loan disbursement process end to end, including application management and review, credit risk assessment, routing applications to the appropriate individuals or teams for review and approval, and disbursement management.

Integration: with other finance and accounting tools, CRMs, or core banking systems to help streamline the loan disbursement process and make it more efficient.

Document management: to store and manage loan-related documents electronically, making it easier to track and retrieve them as needed.

Reporting and analytics: to provide organizations with data and insights about their loan portfolio.

Electronic signature: for digital signing of loan documents to speed up the approval process.

Compliance management: to ensure organizations are adhering to all relevant regulations and laws related to loan disbursement.

Security features: such as encryption and multi-factor authentication help to keep loan-related data secure and protect against unauthorized access.

Why build a custom loan disbursement system?

Why build a custom loan disbursement system?

Better user experience: A simple, user-friendly interface can make it easier for your company employees to navigate the entire process that can otherwise be pretty time-consuming and manual.

Customization: Off-the-shelf tools often lack the features or integrations with other tools that your teams need to automate and manage the multi-step and complex loan disbursement process.

Scalability: You can modify your custom dashboard to include new data sources, features and functionalities as your internal processes evolve.

Control and compliance: Have more control over the development, maintenance and upgrades of your dashboard and ensure you are compliant with all the relevant, evolving regulations.

Flexibility: Build a dashboard you don’t need to rebuild again in 12 months. Easily adapt to changing requirements, internal processes, and new tools and technologies.

Competitive advantage: a custom tool can give your team a competitive advantage by improving their service and speed while also making the process more efficient.

What are the challenges of building a loan disbursement system?

What are the challenges of building a loan disbursement system?

Complex regulations: The loan approval process must be compliant with a wide range of federal and state regulations, which can be complex and difficult to navigate.

User experience: Providing a user-friendly and intuitive interface for the various teams to view, understand, and analyse important information can be a challenge without experienced frontend engineers.

Data integration and cleaning: It can be difficult to integrate with existing systems data as well as clean all the necessary data for the dashboard, such as credit scores, income, employment history, etc.

Data privacy & security: Ensure your customer data is protected from unauthorized access. You can use Appsmith’s built-in role-based access controls to set user permissions before sharing the dashboard with your end users to solve this.

Traceability and auditability: The tool should provide a way to track and audit the loan disbursement process, including the decision-making process, the disbursement of funds, and the communication with the borrower.

Which teams generally use loan disbursement systems?

Which teams generally use loan disbursement systems?

Loan operations teams: responsible for application processing, disbursement management, underwriting loans, and disbursing funds to borrowers.

Accounting and finance teams: to maintain clean records of all loan disbursements in the organization's financial statements

Risk management teams: to monitor the loan portfolio and ensure compliance with regulations.

Compliance teams: to ensure that the organization adheres to all relevant regulations and laws.

Customer service teams: for responding to customer inquiries and providing assistance with the loan disbursement process.

IT teams: for checking and ensuring that the system is secure and reliable.

Sales and marketing: to understand their potential customers’ profiles better.

Why use Appsmith to build a loan disbursement system?

Connect data from multiple datasources.

Connect to various data sources such as databases, REST APIs, and GraphQL servers. Define the data structure of your models, create relationships between them, and perform CRUD operations.

Code only when needed.

Use Appsmith’s visual drag-and-drop interface to design your portal’s UI. You can add different types of widgets, such as forms, tables, and charts, to your pages and customize their appearance using our theming options.

Automate your manual processes and deploy.

Integrate your portal with your internal stack, using Zapier, Webhooks, and more. After designing and connecting various pages on your portal, preview them easily in Appsmith. Then easily deploy your portal to Appsmith's cloud or a host of your choice.

What more can you do with Appsmith?

Build an insurance claim manager, a fundraising CRM, a fraud monitoring tool, or a loan approval dashboard. Use Appsmith to get the job done 10X quicker and with far less engineering bandwidth.

End-to-end automation

Automate the end-to-end loan disbursement process and allow multiple users from different teams to access, interact with, and take action using different parts of the same app. Trigger custom alerts and notifications to specific users based on another user's action.

Get powerful features out of the box

Search, sort or filter data based on multiple criteria without writing any code - just use Appsmith’s in-built features. Paginate data in clicks with pre-built configs. Write JavaScript anywhere in Appsmith to transform your data and trigger actions elsewhere.

Built-in authentication and authorization

Access control based on user roles and display different data views to different users according to authorization settings. Utilize our built-in audit logs to keep track of important events and use backup and restore features as necessary.

Which industries use loan disbursement systems?

Get live support from our team or ask and answer questions in our open-source community.

Watch video tutorials, live app-building demos, How Do I Do X, and get tips and tricks for your builds.

Discord

Videos

Do more with Appsmith

Ship a portal today.

We’re open-source, and you can self-host Appsmith or use our cloud version—both free.